OPINION: High slippages to prevent recovery of LNG shipping charter rates in 2018

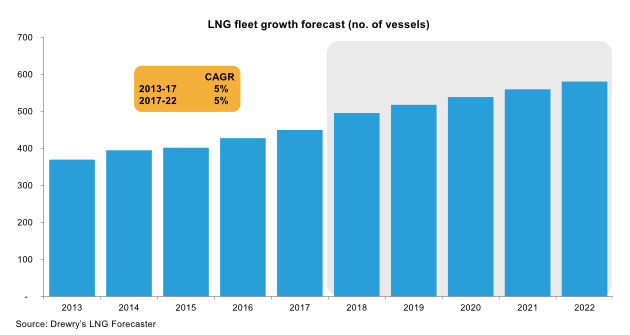

Increasing vessel supply will keep LNG charter rates under pressure in 2018, despite strong growth in trade, according to global shipping consultancy Drewry.

Drewry’s short-term outlook for LNG charter rates remains pessimistic because of the high fleet growth rate compared with demand. The fleet is expected to expand by 11 per cent because of high deliveries and low demolition activity. Low freight rates in the first three quarters of 2017 have resulted in a huge pile-up of deliveries in 2018, which will further put pressure on supply.

In 2017, 43 vessels were scheduled for delivery, while just 27 were delivered during the entire year, and 16 were deferred to 2018. Taking into account the slippages from 2017, 69 vessels – aggregating 11 million cbm capacity – are scheduled for delivery in 2018. However, Drewry believes not all 69 ships will stick to schedule, and therefore, projects that only 45 LNG carriers, with 7.6 million cbm capacity, will be delivered (approximately 12 per cent of the current LNG fleet). Drewry also expects demolitions to remain low.

High slippages of vessels from 2017, along with low demolition activity, will further add pressure on the supply side. Average spot rates are projected to remain lower than charter rates were in 2017. The first quarter of 2018 will be weaker than the last quarter of 2017, and slide further in the second quarter on account of high tonnage availability. However, in the second half of 2018, charter rates will improve as high Chinese LNG imports will absorb the excess tonnage available in the spot market. Overall, the LNG market in 2018 will be marked by a high number of vessel deliveries, low scrapping activity, reactivation of idle fleet and strong Chinese demand.

2018 charter rates will average $45,000 per day, which is marginally lower than rates in 2017. The high slippages of vessels into 2018 will increase vessel supply and put pressure on charter rates. Strong projected LNG trade growth of nine per cent in 2018 will help to create a resistance level to prevent charter rates from falling to the lows seen in 2017.

“Spot vessel availability will remain high during the first half of 2018, leading to below average charter rates. However, we project a strong finish to the year, with increased residential heating demand from China taking charter rates to similar levels as the second half of 2017. We believe the conversion of coal-fired residential heating to gas-fired residential heating in China will be rapid, and thus, the base demand during winter will increase in 2018 as compared with 2017”, commented Shefali Shokeen, Senior Analyst at Drewry.