A Norwegian owner has taken delivery of a new MR tanker while orders have been placed for new VLCCs, ammonia carriers and chemical tankers to be built in India and China. Construction has meanwhile begun on a UK-owned Aframax tanker with wind-assist propulsion systems.

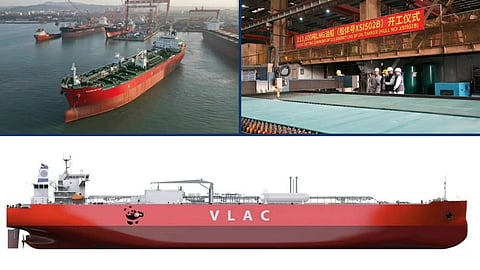

China's Xiamen Shipbuilding Industry has begun construction of the second dual-fuel Aframax tanker in a series slated for UK shipping company Union Maritime (UML).

The ship will be from the same series as Brands Hatch, which was handed over to UML last year following construction at the facilities of China State Shipbuilding Corporation (CSSC) subsidiary Shanghai Waigaoqiao Shipbuilding.

Both ships were designed by CSSC subsidiary Shanghai Merchant Ship Design and Research Institute.

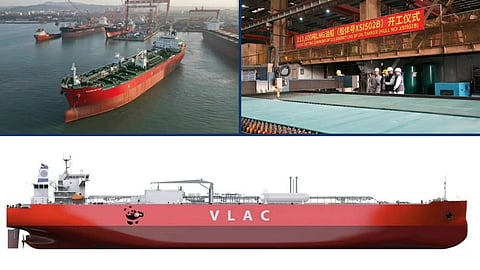

China's Tianjin Southwest Shipping has awarded China State Shipbuilding Corporation subsidiary Jiangnan Shipyard a contract for the construction of two very large ammonia carriers (VLACs) in a series.

The ships' design will feature a low-drag hull developed to achieve a balance between maximising cargo capacity and meeting the dimensional restrictions of the old Panama Canal. This is achieved through optimised bow and stern shapes and waterline distribution, thus significantly improving overall operational efficiency.

The VLACs will each be fitted with a dual-fuel propulsion system and cargo tanks with a total capacity of 90,000 cubic metres.

India's Swan Defence and Heavy Industries (SDHI) has signed a contract for the construction of six IMO Type II chemical tankers. The agreement, valued at $227 million, was made with European shipowner Rederiet Stenersen and is described as the first chemical tanker order placed with an Indian shipyard.

SDHI stated that the contract is "one of the largest" commercial shipbuilding deals for the nation.

The vessels will each have a deadweight of 18,000 DWT and are scheduled for construction at the Pipavav shipyard in Gujarat. The first vessel is scheduled by SDHI for delivery within 33 months, and the agreement includes an option for an additional six sister vessels.

Each tanker will have an overall length of approximately 150 metres and a beam of approximately 23 metres. The designs will be provided by Marinform and StoGda Ship Design and Engineering, with classification by DNV.

Norwegian shipping company Champion Tankers took delivery of a new MR chemical tanker on Thursday, January 22.

Champion Tide was built by Penglai Zhongbai Jinglu Ship Industry of China and is the first newbuild MR tanker to join the Champion Tankers fleet. According to Chinese media, the ship was delivered 107 days ahead of schedule.

The newbuild has a length of 183.1 metres, a beam of 32.2 metres, a draught of 11 metres, and 20 cargo tanks. The interior of each tank has been coated with a special paint that boasts greater resistance to corrosion compared to stainless steel, phenolic epoxy resin, and zinc silicate coatings.

Hengli Shipbuilding Dalian, a subsidiary of Guangdong Songfa Ceramics, has entered into an agreement for the construction of two 306,000 DWT very large crude carriers (VLCC) for single-purpose vessel companies under Eastern Pacific Shipping.

The total value of the transaction is estimated to be between $200 million and $300 million.

Guangdong Songfa Ceramics stated that because the amount involves confidential commercial information, the specific figure is exempt from disclosure. However, the company confirmed that the contract value exceeds 50 per cent of its audited main business revenue from the most recent fiscal year.