2010 was a remarkable year for shipping, strengthening the recovery that started with improved overall volumes in the second half of 2009 and ending with concerns in practically all segments. We are now in the early days of 2011 with a global recovery losing momentum as the macroeconomic drivers behind the economic recovery, such as giant stimulus packages, being phased out and traditional concerns about inflation, deflation and economic overheating challenging national and international economists.

Growth in the advanced economies is forecast by IMF to slide from 2.7 percent in 2010 to 2.2 percent in 2011. Meanwhile, economic growth for emerging and developing countries is forecast to slide from 7.1 percent in 2010 to 6.4 percent in 2011.

Whereas it was expected that consumption and investments would replace the stimulus packages as economic drivers, particularly in the advanced economies, the process has started but needs to strengthen. This translates into positive but not very strong growth. The recovery is weak because of the scars left by the crisis such as cutbacks and rising uncertainty in the labour markets, the severe drop in the value of property and general uncertainty about the economy and the future. Before the crisis changed the world, consumers were big spenders and accumulated debt but now they are more focused on consolidation, which is why consumption is slower to really take off.

On the other hand Asia has managed to move beyond its strength in exports to build a second engine of growth – based on investment and consumption. As Asia's major trading partners, in particular Europe and the US, are entering a period of lower growth rates, the need to nurture Asia's domestic demand over the medium-term has become even more crucial and appears to be moving in a positive direction.

Ship supply: a wall of new ships

All of the main shipping segments, be it dry bulkers, tankers or container ships are facing a wall of new ships to be delivered in 2011. This comes back-to-back with the biggest delivery year ever, 2010. The dry bulk segment is forecast to be hit the most, as BIMCO predicts that the fleet will grow by as much as 14 percent in 2011. For tankers and containerships, the fleet is forecast to grow not less than eight percent.

Supply growth in all segments is biased toward the bigger ships, which is illustrated by the ratio of order book to active fleet. This ratio for Capesize vessels, which are the largest dry bulk ships, is 67 percent. For Very Large Crude Carriers the ratio is 38 percent, while large container ships that are able to carry more than 8,000TEU have a ratio of 95 percent. Normally, this ratio is around 20 percent for bulker and tanker fleets and around 30 percent for the container ship fleet. Despite healthy demand growth forecasts across the board, the main short- and medium term challenge for the industry remains oversupply of tonnage.

Dry bulk shipping: it's all in the hands of China

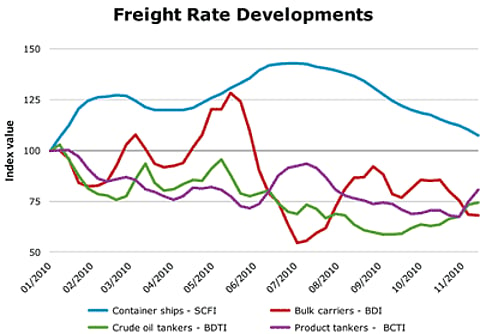

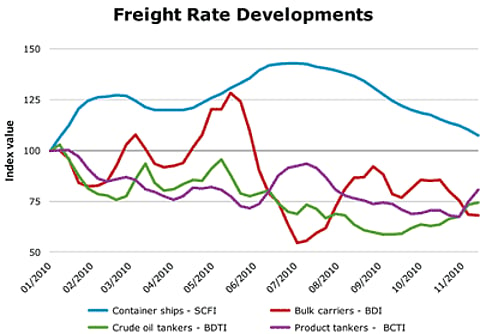

A positive market overall with a mid-year fall-out characterised 2010. The mid-year slowdown saw the Baltic Dry Index fall for 35 consecutive days as China took initiatives to slow growth and avoid overheating the economy and its housing sector.

For 2011, total dry bulk demand is forecast to grow by 7.0 percent, slowing down from the demand hike of 9.0 percent in 2010. The solid demand picture in a relatively stable market has seen owners returning to the yards to sign many new contracts. This happened only a year after owners ran to the yards to renegotiate all contracts in order to avoid receiving the vessels that were already on order.

A new Capesize vessel was launched every second day during 2010 and this is expected to continue in 2011 and 2012. Even with dry bulk demand from the US and Europe to supplement the demand from China, the fundamental balance between supply and demand, in particular in the Capesize segment, will stay in favour of charterers for the coming years. This is a result of the industry's buying spree two years ago before the financial crisis severely slashed sea trade.

Going forward, the dry bulk market will continue its heavy reliance on Chinese demand: a demand that has been so strong in 2009 and 2010 that trade balances have been skewed more than normal and congestion in ports located in the main loading and discharge areas has been severe.

The velocities of the Capesize freight rates movements are expected to continue going into 2011. Meanwhile, the smaller segments are predicted to be in more smooth waters than the bigger vessel types, as the inflow of new tonnage in these segments is less dramatic and the commodities which they transport are more diversified.

Tankers: When will demand catch up with supply?

While product tankers have been under almost constant pressure throughout the year, crude oil tankers have "only" felt the pain of low demand and increasing supply in the second half of 2010. This is the outcome of much lower consumption of both crude oil and refined oil products in the main consuming areas in the Western hemisphere.

Meanwhile, demand in the Eastern hemisphere has proved solid, with China emerging as a large importer of crude oil. The overall trend is clear: it is very positive that Asian demand has grown and will continue to grow, but the East's thirst for oil is not strong enough to offset lower consumption in the West. This is due to fewer tonne-miles.

While the winter markets could prove to be a pause for breath for tankers in the short run, it seems likely that tanker freight rates will remain a bit under the weather in 2011.

For 2011, the crude segment remains the better half of tanker shipping as the product segments are still heavily affected by the weak demand from the main consuming areas, as well as oversupply.

When Western demand growth eventually returns, tanker demand will look strong again as Eastern demand is unlikely to slow down any time soon. Whether the strong tanker demand will also give higher rates is also dependent on fleet development.

However, the underlying trend is more challenging for crude oil tankers than product oil tankers. The business is trending towards higher growth in oil products transport than crude oil transport, as refineries have been and are being built closer to the oil well today than 20 years ago.

Container shipping: an amazing comeback

Container shipping has travelled from a nadir at the beginning of 2010 to the highest point in August where revenue and volumes were at levels not seen since 2008: development characterised by restocking of inventory and a lack of equipment, in particular containers.

During the first quarter of 2010 freight rates went from very low to peak levels and stayed there for half a year until rates started to slide by the end of the traditional third quarter volume peak.

This comeback took many by surprise as the industry managed to handle the oversupply of tonnage with the introduction of widespread slow-steaming and lay-ups to bring freight rates back to sustainable levels, even though for some segments such as smaller vessels the situation has not improved a lot.

Positive volume growth resulted in turn in an extensive reactivation of laid up tonnage to an extent that just 120 vessels were idle by the beginning of November 2010. However, with many newbuildings constantly coming on stream, it remains to be seen to what extent lay-ups will once again be a part of the industry's solution to overcapacity.

Freight rates are expected to slide quietly into the beginning months of 2011, with the momentum of this weakening being greatly dependent on the industry's ability to adjust deployed capacity to transportation demand. Moving further into 2011, the return of consumers to the shops and the creation of more jobs in the EU and US will have a large spill-over effect onto container shipping demand. Intra-Asia demand is expected to stay on a solid growth path, but in order to match the positive note from 2010, and with the restocking effect behind us, real demand must follow in order to bring both volumes and rates upwards once again.

One huge uncertainty is of course how shipyards will react to the slow-down in ordering. Yard capacity is expected to grow from 51CGT in 2010 to 55CGT in 2011 and it is clear that as ships are delivered, orders are not being placed at the same pace. The outlook for 2013 is really scary, with a severe overcapacity predicted. With probably the youngest world fleet in history there is little prospect of a significant increase in ordering, leaving the shipping industry with its traditional dilemma, ship-owning being capital intensive and shipbuilding being labour intensive, and inundated with the usual problems. One can only hope that we will not see the ugly face of subsidies and trade distortions that have been so damaging for world trade and the economy and created unnecessary distrust and suspicion between nations.

BIMCO – Reflections