OPINION | Is LNG poised for a new growth cycle?

Gas needs to work for its long-term sustainability. But the mood music is upbeat. Just 18 months ago the LNG market was depressed, anticipating an extended period of oversupply. Things haven’t played out quite like that, and prices have staged a strong recovery.

The market may not be out of the woods yet, as supply builds up next year potentially putting some downward pressure on prices. But the outlook beyond is bullish, with 65 mmtpa of new supply needed to meet growing demand by 2025 – that’s 20 mmtpa more than we forecast a year ago.

How have things turned round so quickly?

Demand has been firmer. Low prices drew buyers into the market after Asian LNG prices fell 75 per cent from the 2013 peak of US$17/mmbtu to US$4/mmbtu by 2016. China began a buying spree that hasn’t stopped, spurred by the Government’s initiative to improve air quality in its cities. The Paris Agreement of 2015 has hardened energy policy – European governments are accelerating a shift away from coal to the benefit of renewables as well as gas. A new and diverse breed of countries has joined the traditional LNG buyers, among them Pakistan, Bangladesh, Colombia, Jamaica and Panama. LNG has gone global in the downturn.

Europe emerges as key growth target for LNG suppliers

Delayed production startup at some new LNG projects has also diminished the feared oversupply. Future gas supply in Europe will be structurally reduced by the decline of Groningen. The Dutch field, a pillar of continental supply for over 50 years, is beset by earthquakes. Volumes will be cut to minimal levels in the early 2020s and cease in 2030. With Russian pipelines maxed out, even with modest demand growth Europe has emerged as a key growth target for LNG suppliers. The loss of Groningen alone accounts for half of the 20 mmtpa increase in our forecast 2025 supply gap.

Things look brighter, yet major challenges lie ahead for the industry, these three among them.

1. Bringing competitive new supply to market

Projects are jockeying for position including Mozambique Areas 1 (Anadarko) and 4 (Eni/ExxonMobil), Arctic LNG 2 (NOVATEK/Total), LNG Canada (Shell/Petronas), Qatar expansions (Qatargas) and a plethora of US sites. 2019 may be the biggest year ever for LNG project sanctions; 100 mmtpa of new capacity could reach FID in the next three years.

Project delivery and managing spend of up to US$200 billion will be big tests following the difficulties of the last cycle. And with buyers unwilling to commit to long term contracts for all their needs, sellers have to take on more risk. The “new economics” of LNG projects favours big, financially strong players – large resource holders, major portfolio players and, possibly, traders.

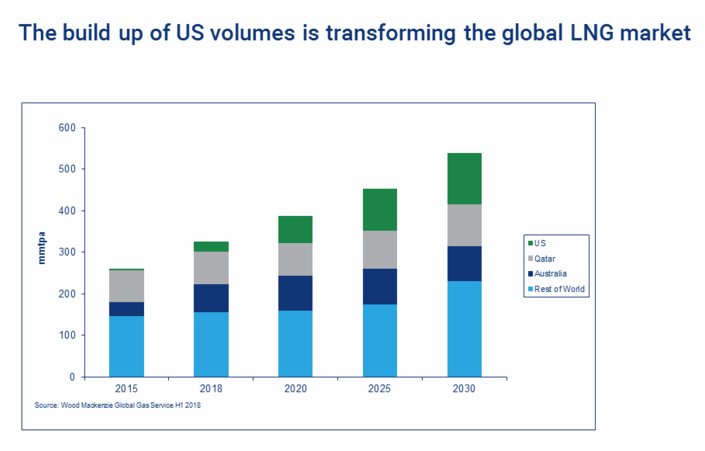

2. The inexorable rise of US supply democratising the LNG market

A fringe player a few years ago, US LNG will vie with Qatar to be the world’s biggest supplier by the mid-2020s. Cheap Permian and Marcellus gas create a competitive advantage versus many conventional projects. Some LNG contracts are already marketed as distinctly Henry Hub, influencing oil-linked LNG pricing. In time a quarter of all cargoes on the high seas will be Henry Hub-derived, FOB with no destination clauses. This will dramatically increase liquidity in LNG trading and the effect on global LNG pricing will be profound.

Gas hubs in the US and Europe have evolved over the decades to accommodate gas/oil competition and arbitrage between spark spreads and dark spreads. So too will Henry Hub be duly absorbed into the global pricing mix in European hubs and Asia. A global LNG marker price will emerge with Henry Hub a key determinant.

3. The need for sustained gas advocacy

Gas is presently winning market share from coal. But intensifying policy on energy efficiency, methane and carbon emissions, the growth of renewables, development of battery storage and new energy technologies all pose a threat. Gas cannot rest on its laurels as a bridging fuel for the energy transition. The industry needs to keep pressing the case for gas as the low carbon intensity option, and continue to build new markets by ensuring security of supply at a competitive cost.