US-based subsea engineering specialist Oceaneering International recently posted its second quarter 2025 results.

As compared to Q2 2024, the company's revenue increased four per cent to US$698 million, operating income increased 31 per cent to US$79.2 million, net income increased 56 per cent to US$54.4 million, and adjusted gross operating profit increased 20 per cent to US$103 million.

Cash flow provided by operating activities was US$77.2 million and free cash flow was US$46.9 million, with an ending cash position of US$434 million.

Meanwhile, shares repurchased were 471,759 for approximately US$10 million.

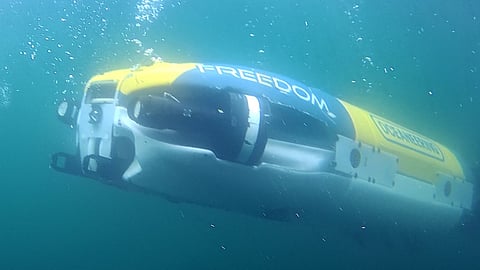

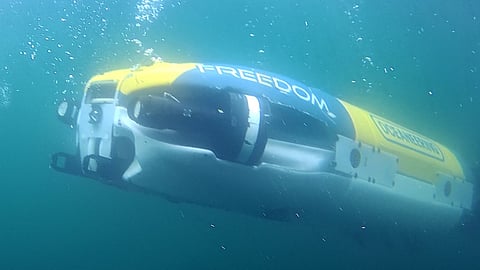

"We achieved these results through commencement of recent contract awards in aerospace and defence technologies (ADT), favourable service mix and strong execution in our offshore projects group (OPG), conversion of higher margin backlog in manufactured products, and continued progression of remotely operated vehicle (ROV) day rates," said Oceaneering President and CEO Rod Larson.

"As expected, all of our operating segments produced quarterly year-over-year improvements in revenue, operating income, and operating income margin."

As compared to Q2 2024, subsea robotics (SSR) operating income improved four per cent to US$64.5 million on a two per cent increase in revenue. Gross operating profit margin expanded slightly to 35 per cent on improved ROV revenue per day utilised, which increased to US$11,265. ROV fleet utilization was 67 per cent.

Manufactured products operating income of US$18.8 million improved 31 per cent on a four per cent increase in revenue, with operating income margin expanding to 13 per cent. Backlog was US$516 million on June 30, 2025. The book-to-bill ratio was 0.65 for the 12-month period ending on June 30, 2025.

OPG operating income increased 64 per cent to $21.7 million on a four per cent increase in revenue. Operating income margin improved to 15 per cent.

ADT operating income of US$16.3 million represented an increase of 125 per cent on a 13 per cent increase in revenue. Operating income margin expanded to 15 per cent.

Oceaneering expects that, as compared to the Q3 2024, consolidated Q3 2025 revenue will increase and consolidated gross operating profit will be in the range of US$100 million to US$110 million.

At the segment level, for the third quarter of 2025, as compared to the third quarter of 2024: SSR revenue and operating profitability are expected to increase; OPG operating profitability is expected to decrease on relatively flat revenue; ADT revenue and operating profitability are forecasted to increase significantly.

Unallocated Expenses are expected to be in the US$45 million to US$50 million range.