Oil States' Q2 profits boosted by growth in offshore segment

Oil States International, a provider of manufactured products and services used in the offshore drilling, completion, subsea, production and infrastructure sectors, reported net income of US$2.8 million, or US$0.05 per share, and adjusted gross operating profit of US$21.1 million for the second quarter of 2025 on revenues of US$165.4 million.

Reported second quarter 2025 net income included charges and credits of US$3.3 million (US$2.6 million after-tax or US$0.04 per share) associated primarily with the exit of US land-based facilities, personnel reductions and gains on the extinguishment of convertible senior notes.

These results compare to revenues of US$159.9 million, net income of US$3.2 million, or US$0.05 per share, and adjusted gross operating profit of US$18.7 million reported in the first quarter of 2025, which included charges of US$0.9 million (US$0.7 million after-tax or US$0.01 per share) associated with the exit of US land-based facilities closed in 2024.

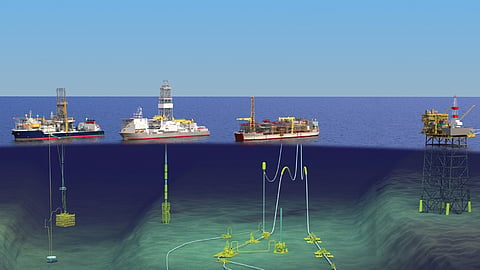

"Our consolidated results in the second quarter were driven by continued strength of international and offshore activity supported by backlog growth over recent quarters," said Oil States’ President and Chief Executive Officer, Cindy B. Taylor.

"Revenues from our offshore manufactured products segment increased 15 per cent sequentially, totaling US$107 million, while adjusted segment [gross operating profit] totalled US$21 million, up 18 per cent. Bookings totaled US$112 million in the period, yielding backlog of US$363 million and a quarterly book-to-bill ratio of 1.1x."

Taylor said Oil States' operating results reported by the completion and production services and downhole technologies segments were "challenged" during the quarter due to the industry-wide reduction in US land completion-related activity. On a combined basis, the revenues and adjusted gross operating profit of the two segments declined 13 per cent and 12 per cent, respectively, from the first quarter of 2025.

Offshore manufactured products results

Oil States' offshore manufactured products segment reported revenues of US$106.6 million, operating income of US$17.0 million and adjusted segment gross operating profit of US$21.1 million in the second quarter of 2025, compared to revenues of US$92.6 million, operating income of US$14.3 million and adjusted segment gross operating profit of US$17.9 million reported in the first quarter of 2025.

Adjusted segment gross operating profit margin was 20 per cent in the second quarter of 2025, compared to 19 per cent in the first quarter of 2025.

Backlog totalled US$363 million as of June 30, 2025, its highest level since September 2015. Second quarter bookings totaled US$112 million and yielded a quarterly book-to-bill ratio of 1.1x and a year-to-date ratio of 1.2x.

Completion and production services results

The completion and production services segment reported revenues of US$29.4 million, operating income of US$1.9 million and adjusted segment gross operating profit of US$8.3 million in the second quarter of 2025, compared to revenues of US$34.5 million, operating income of US$3.5 million and adjusted segment gross operating profit of US$8.8 million reported in the first quarter of 2025.

Adjusted segment gross operating profit margin was 28 per cent in the second quarter of 2025, compared to 25 per cent in the first quarter of 2025.

In 2024, the segment began implementing actions in its US land-based businesses to reduce future costs, which are continuing in 2025. These management actions included: the consolidation, relocation and exit of certain US land-driven service locations; the exit of certain US land-driven service offerings; and reductions in the company’s workforce in the United States.

During the second quarter of 2025, the segment recorded a non-cash lease impairment and other downsizing charges totalling US$2.2 million.

Downhole technologies results

The downhole technologies segment reported revenues of US$29.4 million, an operating loss of US$4.0 million and adjusted segment gross operating profit of US$1.2 million in the second quarter of 2025, compared to revenues of US$32.8 million, an operating loss of US$2.1 million and adjusted segment gross operating profit of US$1.9 million in the first quarter of 2025.

During the second quarter of 2025, the segment recorded a non-cash operating lease impairment and severance charges totalling US$1.2 million.

Corporate expenses

Corporate operating expenses in the second quarter of 2025 totalled US$9.6 million.

Interest expense, net

Net interest expense totalled US$1.7 million in the second quarter of 2025, which included US$0.3 million of non-cash amortisation of deferred debt issuance costs.

Cash flows

During the second quarter of 2025, Oil States generated US$15.0 million of cash flows from operations and US$8.1 million of free cash flows. The company purchased USS$14.8 million principal amount of its 4.75 per cent convertible senior notes at 97 per cent of par and repurchased US$6.7 million of its common stock (2.3 per cent of its shares outstanding as of March 31, 2025).

Financial condition

Cash on-hand totaled US$53.9 million at June 30, 2025. No borrowings were outstanding under the company’s asset-based revolving credit facility (ABL facility) at June 30, 2025.

On July 28, 2025, the company amended its ABL facility to provide for additional borrowing availability, lower interest charges and plan for the retirement of its remaining convertible notes at maturity in April 2026 using, in part, availability under the ABL facility.